In February, we delved into Adam Neumann’s aspirations after the former WeWork CEO expressed interest in buying back the real-estate startup he co-founded 14 years ago. Fast forward to now, and Neumann has reportedly made a bold move with a $500 million bid to acquire WeWork.

According to a report from CNBC, citing a source familiar with the matter, Neumann’s unsolicited bid surpasses the $500 million mark and could reach up to $900 million pending further due diligence. However, the specifics of how Neumann plans to finance this offer remain murky, adding a layer of complexity to WeWork’s bankruptcy proceedings. The company aims to shed some of its long-term commitments in less profitable markets, a move met with resistance from certain lessors.

Although the financing behind Neumann’s bid is unclear, CNBC reports that Dan Loeb’s Third Point is not involved, contrary to previous claims. This uncertainty, coupled with Neumann’s contentious history with the company, might influence WeWork’s reception of his offer. Despite this, Neumann, along with his family office Nazare and his real estate venture Flow backed by Andreessen Horowitz, have filed a notice of appearance in WeWork’s bankruptcy docket.

Recently, news surfaced indicating Neumann’s renewed interest in reclaiming the reins of the company he was ousted from five years ago. WeWork’s bankruptcy filing in 2023 marked the culmination of years of struggles, prompting the company to seek restructuring with the help of bankruptcy advisors.

In response to Neumann’s bid, a WeWork spokesperson reiterated the company’s commitment to evaluating expressions of interest to secure the best outcome. Neumann’s persistent efforts to regain control of WeWork have been met with resistance, including suggestions for debtor-in-possession financing instead of a conventional term sheet.

“As we’ve said previously, WeWork is an extraordinary company and it’s no surprise we receive expressions of interest from third parties on a regular basis. Our Board and our advisors review those approaches in the ordinary course, to ensure we always act in the best long-term interests of the company,” a WeWork spokesperson said Monday in a statement.

WeWork’s journey from a celebrated unicorn startup to a bankruptcy filing in 2023 reflects the tumultuous path of this once-promising enterprise. Despite Neumann’s ambitions, WeWork remains focused on its restructuring efforts to ensure long-term viability. As Neumann and his legal representative Alex Spiro have yet to comment on CNBC’s inquiries, the saga surrounding WeWork’s future continues to unfold.

WeWork’s troubles began after scrapping the IPO, revealing its financial state, and highlighting the immense control held by its eccentric founder, Adam Neumann. Subsequently, in its rush for growth before going public via SPAC, WeWork committed to costly leases, resulting in ongoing challenges.

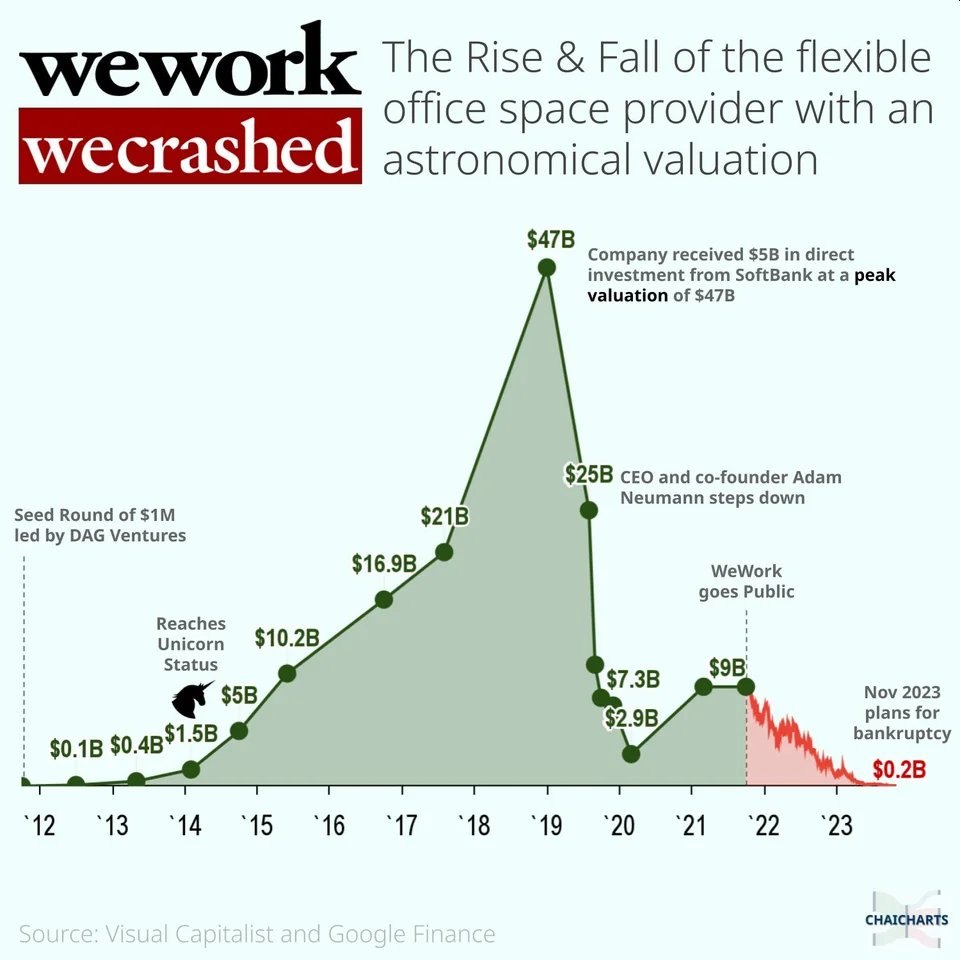

At its peak, the company was valued at $47 billion. However, it has experienced a continuous decline, with its stock plummeting by 98% this year, culminating in an approximate value of just $45 million as of late last year.

WeWork was founded in 2010 by Adam Neumann and Miguel McKelvey. It provides members worldwide with space, community, and services through both physical and virtual offerings. Its mission is to create a world where people work to make a life, not just a living. As of Q2 2019, WeWork had 528 locations in over 111 cities and 29 countries. WeWork reported a third-quarter loss of $1.3 billion from a revenue of $934 million in 2019. Before filing for bankruptcy, the office-sharing startup had about 650,000 subscribers worldwide and hopes to hit 1 million by early 2021.